Considerations for a Roth IRA Conversion

In theory, whether to do a Roth conversion is simple: if you expect to withdraw money in retirement from your IRA at higher tax brackets than you are in now, do a Roth conversion. If you expect to withdraw money from your IRA in retirement at lower tax rates than you are in now, do not do a Roth conversion. However, there are a host of qualitative and quantitative factors that could make a Roth conversion more or less attractive depending on your circumstances.

Personal and Overall Tax Rate Projections Matter Before Doing a Roth Conversion. Many people analyze a Roth conversion in the context of their current income tax bracket versus their projected bracket in retirement. However, you could be in a much different marginal tax rate if the brackets themselves change. In fact, tax brackets are currently scheduled to change in 2026, with the top bracket going back to 39.6% from its current 37% level. With a ballooning Federal budget, many expect that we could be experiencing some of the lowest tax brackets of our lifetime, which would make Roth conversions more attractive. Moreso, it is possible that Roth conversions, as a financial planning tool, could be eliminated by Congress in the future, which also makes them currently more attractive.

Income Growth on Roth Conversions. On the other hand, people have been erroneously predicting higher tax rates for decades. If inflation continues to markedly increase at a brisk pace, tax brackets will continue to adjust up. For those that do not have income keeping pace with inflation, Roth conversion could be a terrible idea as they potentially could see lower effective tax rates during their distribution years.

How You Pay for the Roth Conversion Really Matters. The math of Roth conversions is clear: if you are paying the taxes for the Roth conversion by distributing from your IRA, the conversion is likely not going to save you money. It’s an even worse idea to pay the 10% tax penalty for a distribution under 59.5 years old to do a Roth conversion. However, utilizing funds that would have originally gone into a brokerage account to pay for a conversion is more compelling. This is because funds that are invested in a brokerage account are subject to taxes on both gains and income; reducing the amount in the brokerage by paying taxes for a conversion reduces the percentage of assets that are subject to annual taxes. Additionally, depending on the return and the time period, this benefit can still make a Roth conversion advantageous, even if you anticipate lower tax rates in your distribution years. For some people considering a Roth conversion, the current break-even tax rate could be as little as only 2% to 3% higher than their eventual distribution tax rate. This would be a direct result of having fewer brokerage funds from paying the taxes on the Roth conversion up front. The positive impact of the Roth conversion increases over time, so a longer time horizon for the person doing the conversion makes it that much more favorable.

Time Roth Conversions to Smooth Income and Optimize Life Events. Our marginal tax system penalizes variable income. For example, if you make $100,000, $300,000, then $200,000 over three years, a three-year average of $200,000, you’ll pay around $124,000 in Federal taxes under the 2024 brackets. If you made $200,000 each of those three years, you’d pay $115,000 in taxes, or about $9,000 lower. You can use a Roth conversion to smooth income out and mitigate the tax impact of oscillating between tax brackets. In lower income years, or perhaps in a year when you changed jobs and didn’t have income for several months, or as a business owner you had a down year, you might want to consider a Roth conversion. You can also be opportunistic in other ways, like doing a Roth conversion after a sharp market decline.

For those that a Roth conversion makes sense, one effective strategy is to do Roth conversion with amounts that fill up lower tax brackets. For example, the top of the married filing joint 24% tax bracket is $383,900 in 2024. If you and your spouse had $340,000 of income, it might make sense to do a conversion of $43,900. In theory, if you distribute the Roth funds in retirement and you are in a bracket above 24% you achieved tax savings. Conversion amounts above $43,900 in this example might put you in the 32% bracket, which has less of a probability of working out. After retirement, income for most people will drop dramatically for a few years. This might be the optimal time to fill up those low brackets before you take Social Security and begin required minimum distributions (RMDs) which will result in more income on the tax return.

Factor State Tax in Your Roth Conversion Decision. You might want to think carefully about how your state income tax factors into your conversion decisions. Oftentimes, it doesn’t make sense to do a Roth conversion if you live in a high tax state like New York and are planning on spending down your IRA in retirement in a low tax state like Florida or Texas.

Consider Your Heirs on Roth Conversions. As well, it might make a lot of sense to do Roth conversions in Florida if a majority of your IRA is inherited by your high-earning child in New York and is subject to the 10-year distribution rule.

Spending Needs Impact Roth Conversions. If you won’t spend down your IRA in your lifetime, you might want to think through your spouse’s potential tax rates and factor that into the Roth conversion decision. Someone in bad health might want to do Roth conversions to maximize the deductibility of medical expenses since the deduction is subject to a 7.5% of AGI floor. Increasing income through a Roth conversion can make more of those large medical expenses deductible. Furthermore, if the spouse is expected to pass, they may want to consider a Roth conversion so their surviving spouse will have smaller RMDs when they become a widow or widower. Otherwise, the larger RMDs could suddenly place them in a higher single tax bracket compared to the lower bracket they are accustomed to with married filing jointly.

Keep in mind that distributions within the first five years of a Roth conversion may be subject to taxes and penalties. It is because of this that a Roth conversion should be avoided if you don’t have enough income and assets to fund spending over the medium term. When considering the optimal retirement distribution strategy, money in your Roth IRA should be the last money you spend to avoid the 5-year rule and maximize the benefit of tax-free growth.

Consider the Near Term and Long-Term Effects of a Roth Conversion. A Roth conversion can ripple through your tax return and have unintended consequences. It’s best to work with your CPA and/or financial planner to do an actual tax projection towards the end of the year when you have a good sense of your expected income and deductions. That way you can see what the near-term impact of the conversion will really be. For example, a conversion could unexpectedly push you to being subject to the 3.8% net investment income tax (NIIT) ($200,000 single, $250,000 married filing jointly) or push you into the next capital gains bracket. For those that own pass-through businesses, there could be an optimal amount of Roth conversion that might increase your 20% Section 199A deduction by increasing your taxable income. However, doing a Roth conversion that is too large could push you into income levels that would phase you out of the 199A deduction entirely.

You’ll also want to understand what a Roth conversion will do to your tax return in the years to come. For those nearing retirement, a Roth conversion can potentially increase the amount you pay for Medicare Part B and D. The lookback period is two years, so maybe you want to do Roth conversion prior to age 63. On the other hand, consistent large Roth conversions would decrease your required minimum distributions (RMDs) after 73 or 75. A lower AGI can help decrease the taxability of Social Security, lower Medicare premiums, impact ACA credits, and other favorable outcomes. Rule of thumbs can be challenging in this area, so it’s best to work with your CPA and/or financial planner to run projections to determine the optimal course of action.

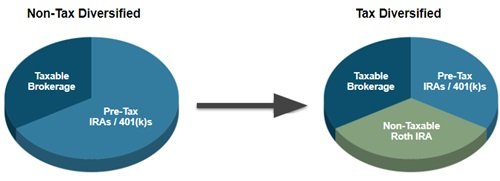

Roth Conversions Can Give You More Tax Planning Options. Perhaps the expectation is that you will be in the same tax bracket the rest of your life, and you do not have any of your assets in a Roth IRA. At first glance, it may seem like there isn’t a compelling reason to do a Roth conversion. However, there might possibly be an incremental benefit of doing at least a small Roth conversion to give you tax account diversification and flexibility in distribution planning during retirement. To fund expenses in retirement, you’ll be faced with decisions on which bucket of assets would be optimal to draw from in any given year. In one year it might make sense to draw first from a taxable brokerage account, but in other years it might be more ideal to draw from a taxable IRA or Roth IRA. Having a mix of different types of accounts can create more optimal tax outcomes. As well, having a balance of funds in after-tax Roth IRAs, brokerage accounts, and pre-tax IRAs could hedge against changes in the tax law favoring one type of account relative to another.

Consider Asset Protection Benefits of a Roth Conversion. In an increasingly litigious environment, people in certain professions like doctors, architects, and property managers are potentially more exposed than others to being sued, putting their financial assets at risk. While IRAs overall typically don't have asset protection as strong as ERISA-based plans such as 401(k)s, many states afford greater protection for funds in IRAs relative to regular brokerage or bank accounts. One way to diminish risk to assets is to increase the ratio of assets in protective structures like IRAs relative to assets in non-protective structures like brokerage and bank accounts. For example, a person with $1,000,000 in an IRA and $500,000 in a brokerage account has 67% of their total portfolio assets protected. If that person converted $400,000 of their IRA to a Roth IRA by paying the taxes out of their brokerage account, they would increase their percentage of protected assets to 74% assuming they were in the 35% bracket. This positive impact doesn’t hold true if you use IRA assets to pay the taxes on a Roth Conversion however.

Consider Roth Conversions to Mitigate Charitable Deduction Income Limitations. Since the IRS limits the charitable deduction amount to a maximum percentage of AGI (20% to 50% depending on the institution and donation type), those that give large amounts to charity relative to their income could have an issue getting a deduction for their donation in the year of the contribution. A Roth conversion could boost income in a year where you don’t have enough AGI to get your full charitable deduction. If you don’t boost income through a Roth conversion, you can carry forward the unused charitable deduction over five years, but the present value of the deduction diminishes.

Roth Conversions and Estate Planning. Tread carefully when considering estate planning around large IRAs as mistakes could cost you significant amounts in tax liability. For those families with a large balance sheet subject to the Federal estate tax, Roth conversion can be attractive as taxes paid for conversions “shrink” the taxable estate. Regular IRAs in estate tax situations are essentially subject to double taxation as the estate tax is applied to the gross amount of the IRA, and then income tax is due when the heir takes a distribution. A Roth IRA conversion works particularly well when heirs are in a higher tax bracket. Moreover, there is no “step-up” in basis for assets held in taxable IRAs. Doing a Roth conversion preserves more assets for the second generation. This is also advantageous in states that have estate exemption at lower levels.

One thing to note is that if there are large planned charitable bequests, it might make sense to not do Roth conversions and leave the charity as beneficiary since the estate will get a full charitable deduction and no one will pay income tax on the IRA distributions.

When it comes to trust planning around IRAs, Roth conversions can also be an effective strategy. Roth IRA beneficiaries subject to the SECURE Act’s 10-year rule aren’t subject to RMDs in years 1 to 9 so conversions can be a way of sheltering gains and income longer for your heirs. Moreover, the 10-year distribution rule has made having trusts as beneficiaries very expensive given the compressed brackets and exposure to the 3.8% NIIT. Converting IRAs to Roth ahead of time and naming them as trust beneficiaries can potentially be a better way to control assets after passing with spendthrift provisions and asset protection.

David Flores Wilson, CFP®, CFA, CEPA is a New York City-based CERTIFIED FINANCIAL PLANNER™ Practitioner & Managing Partner at Sincerus Advisory. Click here to schedule a time to speak with us.